Why Equity Doesn’t Work in All Markets

It is not uncommon for tech companies or growing companies to offer future or prospective employees equity. Some would argue that in tech, offering equity is almost par for the course, as it serves both as a benefit and a talent retention mechanism. Mexico is a different market. It is still a cash society (perhaps why Fintech has such potential there).

In the United States, offering employees equity is about boosting the overall compensation and benefits package. It works. The U.S. has a broad culture of formal investment mechanisms such as stock options, 401Ks, IRAs, and so forth. Culturally, investment opportunities are the norm. This is especially the case in tech, as emerging startups can use it to entice high level talent. Offering equity is especially popular for startups that depend on seed funding and have limited cash flow.

Formal Savings Accounts in Mexico

The Center for Financial Inclusion reported in 2018 that the percentage of adults in Mexico who save using formal institutions went from 15 percent to 10 percent. This decline stands even after the government has implemented financial inclusion strategies.

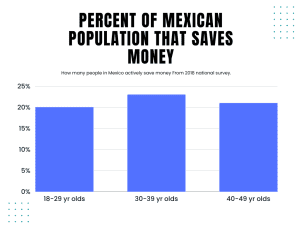

This is not the norm, however —at least not to a large degree— in Mexico. Bloomberg Linea reported in 2021, that although 47% of economically active people in Mexico save money, they do so via informal means or simple savings accounts. The 2018 national survey indicated that only about 20% of the population between 18 to 29 years old save money, with 23% of people between 30 to 39, and 21% of people between 40 and 49. In 2022, La Jornada, a Mexican publication, reported that the percentage of people without any type of savings was 40%.

Why Latin America Tends to Save Less

The reasons for this are varied and difficult to quantify. Indications suggest there are structural, cultural, and historical reasons for this. According to research by the Inter-American Development Bank, Latin Americans are less prone to saving because of distrust of financial systems. This lack of trust is the 2nd most cited reason for why Latin Americans avoid having formal savings accounts. This distrust stems from past indiscretions by formal banking institutions. Other reasons cited include limited financial literacy and a preference for saving cash money at home.

Equity for Talent Retention, Not in All Markets

So, while offering equity is a great option for talent retention, it may not have the same weight in all markets. Based on our experience working with tech talent in Mexico, equity does not have the same allure that it does in the United States. Mostly, it’s simply because it’s not openly understood in Mexico. Instead, talent in places like Mexico seek better immediate benefits such as access to healthcare, gyms, and office perks.

In our time working with Mexican software developers and engineers, we have learned that junior and senior-level talent are not all that interested in equity as a substitute for salary compensation. If you are hiring software developers in Mexico, consider other benefits such as flexible work hours and better healthcare packages.

Challenges of talent retention can be mitigated by understanding the market in which you source your talent. The Mexico IT industry is diverse and full of possibilities. What else would you like to know about hiring remote developers in Mexico?